January 1st, 2018 was a landmark moment for taxation in Dubai. For the first time, VAT was introduced to the state, which has lead to much confusion and debate among business owners. Below, we’ll look at what this change means for you as a business owner, and how you may wish to navigate the transition.

What is VAT?

VAT stands for “Value Added Tax”. It is common in the majority of countries around the world but is a newcomer to Dubai. VAT is levied on goods and services; it’s a kind of additional transaction charge which is calculated on a percentage basis. All UAE states, including Dubai, will be levying a 5% VAT tax.

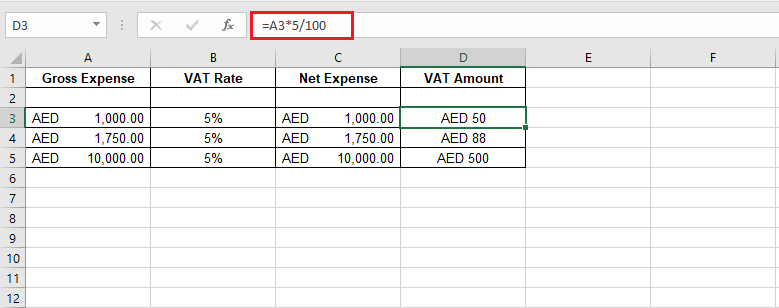

To manually calculate the VAT portion in any charge, here is a simple formula:

Gross Price x 5% / 100.

By using the example above based on a gross price of Dh1000, the VAT charge would be Dh50.

For any individuals who have a financial role in any business the company, the easiest way to calculate the VAT applicable on all of your goods and services is to use an excel spreadsheet. Below is a screenshot of the easiest way to calculate your VAT.

Why is VAT being introduced in the UAE?

As mentioned, VAT is commonplace in other major economic countries; the rate is often much higher than 5%, too. For example, VAT is between 1-16% in the USA and is set at 20% in the UK, so 5% is relatively small.

VAT is seen as a valuable method of revenue raising for governments. It’s estimated that the implementation of VAT will raise Dh12 billion in its first year alone, with rates continuing to climb after this.

How will VAT affect businesses?

If you own a business that purchases goods or services that are subject to VAT, you will see a spike in the cost of these products. However, you will be able to register to reclaim the VAT you pay on business costs.

However, not all VAT is recoverable. You won’t be able to reclaim VAT on costs involving imports, domestic purchases, and VAT self-assessed by the provider. Businesses will also need to prepare their accounts to collect the VAT that their sales generate, which will be an extra accounting burden.

Businesses were required to register for VAT and obtain a Tax Registration Number (TRN) by the January 1st, 2018 implementation date if their turnover exceeds Dh375,000. If you have not done this, you may be subject to a fine of up to Dh20,000. You will also need to cease invoicing or sales until you have your TRN.

Voluntary registration is also an option if you wish to pursue it. You can voluntarily register your business for VAT if your turnover is at least Dh187,500.

Does the implementation of VAT mean businesses should raise their prices?

In a nutshell: yes. Businesses are best to add 5% to all current prices to cover the costs of the VAT. The best way to do this is to show/quote prices without VAT, then add the VAT on at the invoicing stage. You can also just factor the VAT into the total amount if you prefer, the choice is yours.

If you are happy to pay the VAT without raising prices for customers and clients, that’s fine also; you just need to be aware you will need to pay an additional 5% in tax to the government.

In Conclusion

VAT requires extra work from a business, and the early phase of implementation can be complicated. However, in time, companies should be able to adjust to the new tax, as will their customers and clients.