Cavendish Maxwell is a highly respected independent firm of chartered surveyors and property consultants, focusing on property services throughout the Middle East and Africa. Established in 2008, Cavendish Maxwell has grown into one of the region’s largest and highest profile property companies, employing over 60 people across 8 departments.

Our experience covers property, land and business asset valuations; investment; asset management; disposals and acquisitions; rent reviews; lease renewals; development appraisals; advisory services; market research; feasibility studies; project management and building consultancy.

The Cavendish Maxwell Quarterly Residential Market Report for Dubai provides analysis and summary of the apartment and villa properties, highlighting the price movement, rent and yield scenario, residential supply as well as the macro-economic factors impacting this segment. The report also incorporates the Cavendish Maxwell Residential Market Survey conducted among agents operating within Dubai. The survey showcases how new enquiries, leasing activity and transactions, among other metrics, changed over the previous quarter and also provides an outlook on the following quarter, with predictions by professionals being studied against real performance.

Dubai residential market highlights

Macro-economic factors

• Housing and utility costs rose 4.2% from a year earlier in November while food and beverage prices climbed 2.3%.

• In August, the Dubai Government changed the base year for the consumer price index to 2014 from 2007 and adjusted the consumer basket. This had the effect of raising recent inflation rates slightly.

As of October, the International Monetary Fund (IMF) forecast Dubai’s GDP to grow by 3.3% in 2016, down from the 3.5% growth of 2015, before recovering to 3.6% in 2017.

• Overall growth in the UAE is expected to decline to 2.3% in 2016, down from 4% in 2015 due to the effect of lower oil prices on the economy. In 2017 the IMF expects a slight recovery in GDP to 2.5%.

• The IMF’s regional director highlighted that debt levels in the UAE economy remain a key indicator, especially in Dubai where debt levels have been relatively high since the 2009 global financial crisis.

• The most recent estimates of debt levels for Dubai in April 2016, estimated total public and private sector debt at about 70% of GDP, a comparatively high figure albeit lower than peaks recorded in 2009.

An updated assessment of Dubai’s debt levels are expected from the IMF in the spring of 2017.

The strengthening of the US dollar has made the UAE dirham stronger relative to other foreign currencies thus impacting inflow of capital into tourism, retail and real estate sectors from the economies of Europe, India and Russia.

• The decision to raise interest rates for the second time in a decade sent the US dollar to a 14-year high against the euro in mid December.

• Meanwhile, analysts estimate a rocky 2017 for the UK pound sterling as policymakers begin the process of European Union exit. Article 50 (that governs the exit) is likely to be “triggered” as early as the first quarter of 2017.

Fuel prices decreased in December with Super 98 at AED1.8/litre, Special 95 at AED1.69/litre and E Plus91 at AED1.62/litre. The diesel price was AED1.81/litre for December.

• Petrol prices in the UAE in December decreased by an average of 5% in comparison to November and have increased by 1% since January 2016.

• The Ministry of Energy announced that petrol and diesel prices will rise in January by 6.1% to 7.1% for all types of fuel.

• Super 98 prices will rise to AED1.91 up 6.1% from December; Special 95 will cost AED1.80, up 6.5% and E Plus will cost AED1.73, up 6.7%. Diesel will cost AED1.94, up 7.1%.

Oil prices have risen nearly 25% since mid-November, following the landmark deal by OPEC members to begin supply cuts.

• The official start date for countries to begin cuts was Jan 1, with OPEC and non-OPEC producers expected to lower production by almost 1.8 million barrels per day (bpd).

• Saudi Arabia, which is OPEC’s largest producer, has agreed to bear a significant portion of the cuts.

• The Iraqi Oil Minister also indicated that the country would cut supply by 200,000-210,000 bpd from January.

Price performance

Apartments

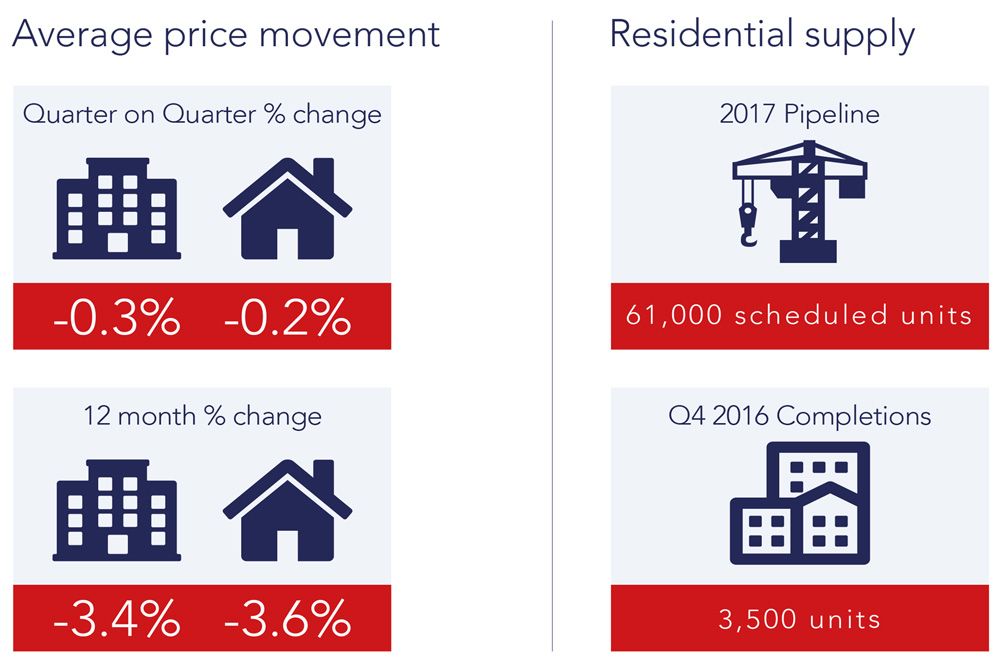

Apartment prices in Dubai declined by 0.3% on average during Q4 2016 and declined by an average of 3.4% over the last 12 months.

• Residential property prices in Dubai have declined by over 15% since highs seen in Q2 2014.

• Stronger US dollar, relatively lower oil prices and resultant liquidity conditions have impacted the purchasing power of regional and foreign investors traditionally active in the Dubai real estate market, such as GCC nationals and buyers from countries like India, UK, Russia.

• According to Dubai Land Department data for October and November, Business Bay and Dubai Marina accounted for the highest number of completed unit sales.

Villas

Villa prices decreased marginally in Q4 2016, with an overall average drop of 0.2%. Over the last twelve months villa prices have declined by 3.6% on average.

• Prices in Arabian Ranches, Meadows and Al Furjan have registered the highest twelve month declines.

• Larger units in peripheral areas that have limited amenities and infrastructure are expected to fare worse than smaller units in developed areas with quality amenities and infrastructure.

• Existing offerings are primarily catering to the mid to high income groups and as the market matures developers will need to provide products to a wider segment of the market. New launches in the ‘affordable segment’ have been announced in 2016 and these are expected to be handed over 2018-19 on wards.

• Marginal declines are expected to continue in 2017 and a turnaround will be largely dependent on oil prices and US dollar movement.

• Residential demand is primarily driven by job growth for expats and redundancies in the high income jobs have kept net job growth at low levels. In comparison, residential supply continues to expand, albeit at slower rates than pre-2009 and 2013-14 levels.

Rent performance

Residential supply

Q4 2016 Completions:

Approximately 3,500 residential units have been completed during Q4 2016, taking the total completions for the year to nearly 16,400 units.

• Nearly 84% of the total number of units completed in Q4 were apartments, with the majority of them located in Silicon Oasis and Dubailand.

• 58% of the units delivered in Q4 2016 were projects delayed from the first three quarters of 2016.

• New launches during Q4 2016 include the affordable housing project Rahaba Residences by Dubai Properties, located in Dubailand. The first phase of the project will have 200 studio units of sizes ranging from 27 to 36 square metres.

Pipeline 2017:

There are about 61,000 units scheduled to complete in 2017, though delays are likely to greatly reduce actual delivery.

• As the map below highlights, the majority of residential units set to be delivered in 2017 are located in Dubailand followed by Business Bay and Dubai Sports City.

• Apartments comprise approximately 76% of the 2017 scheduled supply.

• Nearly 13,000 units have been delayed from 2016 to 2017.

Methodology

• Sale Prices and rents are derived from Property Monitor, a comprehensive real estate platform established in 2014 to provide real-time, market-wide access to transactions and trends. Working

with agencies, banks, developers and corporate investors, it provides a deeper insight into real estate advisory, investment, and lending activities. The average sales price per sq. ft. is based

on the Property Monitor Index that incorporates signed contracts, registered transactions, valuations & listings verified by Cavendish Maxwell valuation department.

• Cavendish Maxwell Residential Market Survey is a quarterly survey aimed at agents operating in UAE and is designed to identify sentiment of the residential market in the region. Forming a part of the Quarterly Residential Market Report released by Cavendish Maxwell, the research showcases how new enquiries, leasing activity and transactions, among other metrics, changed over the

previous quarter as per information from agents. The survey also provides an outlook on the following quarter, with predictions by key market players being studied against real performance.

• Supply projections for residential projects are based on regular tracking of construction status, new launches, delays, etc. This is carried out through site inspections as well as discussion with developers, contractors, in-house building consultancy team and related government entities.

Development Advisory and Real Estate Research