Infrastructure spending to boost GDP growth in Dubai despite macro-economic headwinds

Real GDP growth in the emirate is forecast to rise to 3.1 % this year, in comparison to the 2. 7% growth in 2016 according to the Economic Development Committee. Infrastructure spending in preparation for Expo 2020 is expected to boost GDP growth, with a 27% rise in spending in this sector within the 2017 budget of AED47.3 billion.

Despite the increased infrastructure spending, the Dubai economy continues to be impacted by external macroeconomic factors, including barriers to investment inflow from traditional markets such as India, Turkey, Egypt, the UK and the EU, where currencies have depreciated against the dollar over the past 12-24 months. Additionally, increasing competition and a strong dollar is pressuring blue-chip companies in Dubai, prompting restructuring and job cuts.

Rent declines and a strong dollar could balance rising consumer prices, which are expected to be pushed higher this year as a result of rising utility and energy costs and school fees This expected rise in inflation rates is forecast to continue throughout 2017 and spike further in 2018 with the planned introduction of the VAT system.

Mortgage rates in the country are expected to rise in tandem with the US. Federal rate increases due to the dollar peg. The first of such increases was effected by the UAE Central Bank in March 2017. Current consensus predicts two more US. Federal rate hikes of 0.25% each in 2017. First time buyers taking out a mortgage will have to realign their budgets accordingly and banks in UAE have been offering incentives such as no-processing charges and current account linked mortgage to cater to a wider base of buyers.

Positive signs at the start of the year have come from oil prices stabilizing close to the $50 a barrel mark after OPEC announced output cuts in November. This should have a positive impact on the UAE federal budget.

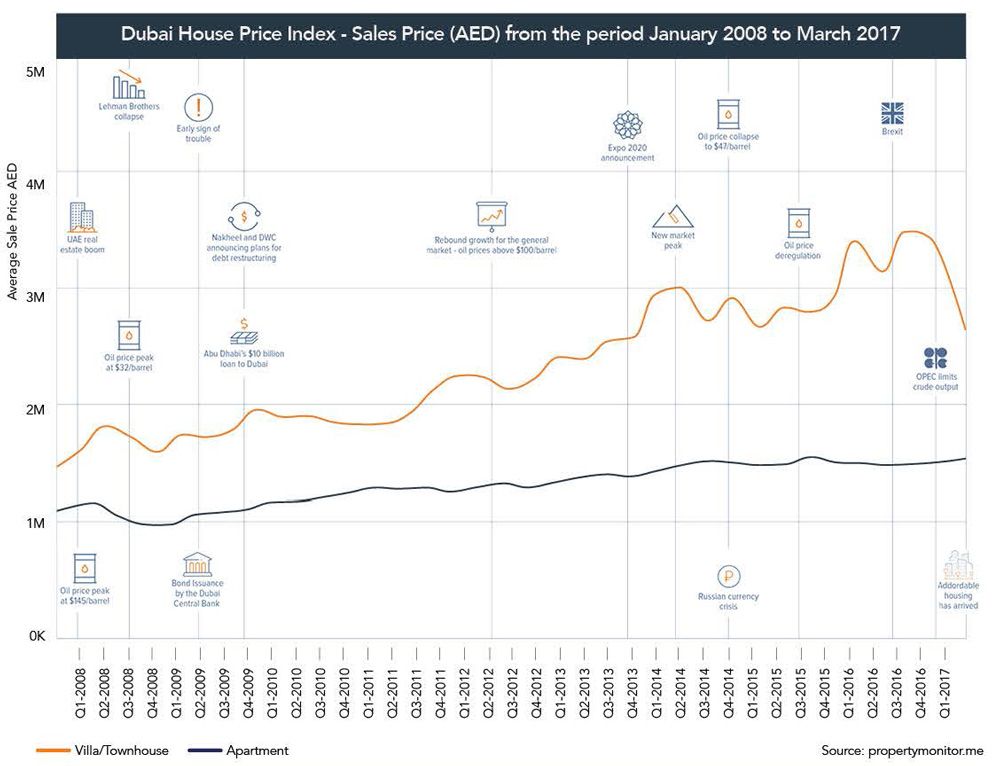

In Q1 2014, average residential prices surpassed the AED3.0 million mark for the first time since 2008, and have since averaged between AED2.5 million to AED3.7 million. However, in Q1 2017, the average villa/townhouse price stood at AED2.2 million as a result of significant lower priced villa inventory (starting prices at AED1 .0 million) coming to market in areas such as Reem and Dubai land.

By contrast, average apartment prices have traded within a dose range of AED1.0 million to AED1.5 million since 2010 even with new supply being added each quarter.

The current gap in the Dubai residential market is for affordable housing, especially catering to salaried individuals in the AED8,000 to AED12,000 per month income bracket. According to the Dubai Statistics Center the population of the emirate of Dubai was estimated to be 2.4 million in 2015. An additional 1.1 million individuals make up a total of 3.5 million active individuals within the emirate of Dubai during peak hours. This includes workers and temporary residents, with the non-resident worker population historically choosing to live in the neighboring emirates due to availability of cheaper accommodation.

Price performance: Marginal price declines continue, averaging 1.0% year on year for apartments and villas in 01 2017.

Prices for apartments and villas in Dubai have continued to decline through 2016 into 01 2017. Cedre Villas in Silicon Oasis, apartments in International City clusters, IMPZ and Jumeirah Lakes Towers all experienced year on year declines of 2.0% on an average in Q1 2017. The rate of decline has slowed significantly since last year and in some locations prices have shown no quarter on quarter change in Q1 2017.

Rent performance: QoQ % change in rents averages -0.5% for apartments and -0.7% for villas in Dubai

Apartment and villa rents across Dubai continued to decline in Q1 2017 and declines were more pronounced among studios in DIFC, International City clusters and Dubailand as well as 4 bedroom villas in Victory Heights. These categories of units exhibited QoQ% declines of more than 2.5%.

In recent months tenants have been able to negotiate terms downwards on renewal and the number of landlords offering flexibility to pay annual rent through multiple cheques has increased. Employers are slowly replacing housing allowances with monthly salary components and hence tenants are likely to continue negotiating on both rent as well as multiple cheques.

Residential supply: Approximately 2,500 residential units have been handed over across Dubai during Q1 2017

Nearly 88% of the units handed over in Q1 were apartments in areas such as Jumeirah Village Circle, Upcoming supply (Q2 – Q4 2017) Sports City, Silicon Oasis, Dubailand, among others.

New launches during Q1 2017 ranged from midscale units in Danube’s Resortz project in Arjan featuring 419 apartments, MAG 5 Boulevard third phase in Dubai South with studios starting at AED310,000 to villas in Dubai Properties’ La Quinta, the second phase of its Villanova residential master community and luxury villas in Al Barari’s The Nest project in Nad Al Sheba.

As of March, approximately 35,000 units are scheduled for handover for the remainder of the year. Historically there has been a considerable gap between the number of units announced for completion and actual handovers. While some projects are delayed as a result of financing issues and extraneous factors impacting the residential market, the majority of delays over the last 12-18 months stem from a conscious staggered delivery schedule being set by developers. This acts as a supply control mechanism to align handovers with demand and project sales potential and to avoid flooding the market with units that cannot be absorbed. Developers are expected to continue phasing the delivery of projects by focusing on absorption of limited released units before more supply is brought to market.